Student Personal Loan App:- Till some time ago, we had to apply for a personal loan by going to the bank or the office of any private loan-giving institution, but in today’s time, you do not need to go anywhere, there are many such Student Personal Loan Apps where you can apply if needed. You can take loan only by doing KYC, just like you use a mobile app in your smartphone for different needs, in the same way you will use some NBFC loan applications for Student Personal Loans.

कुछ समय पहले तक हमें पर्सनल लोन के लिए बैंक या किसी प्राइवेट लोन देने वाली संस्था के ऑफिस में जाकर अप्लाई करना पड़ता था, लेकिन आज के समय में आपको कहीं जाने की जरूरत नहीं है, कई ऐसे स्टूडेंट पर्सनल लोन ऐप हैं जहां यदि आवश्यक हो तो आप आवेदन कर सकते हैं। केवाईसी करके ही आप लोन ले सकते हैं, जैसे आप अलग-अलग जरूरतों के लिए अपने स्मार्टफोन में मोबाइल ऐप का इस्तेमाल करते हैं, उसी तरह स्टूडेंट पर्सनल लोन के लिए आप कुछ एनबीएफसी लोन एप्लीकेशन का इस्तेमाल करेंगे |

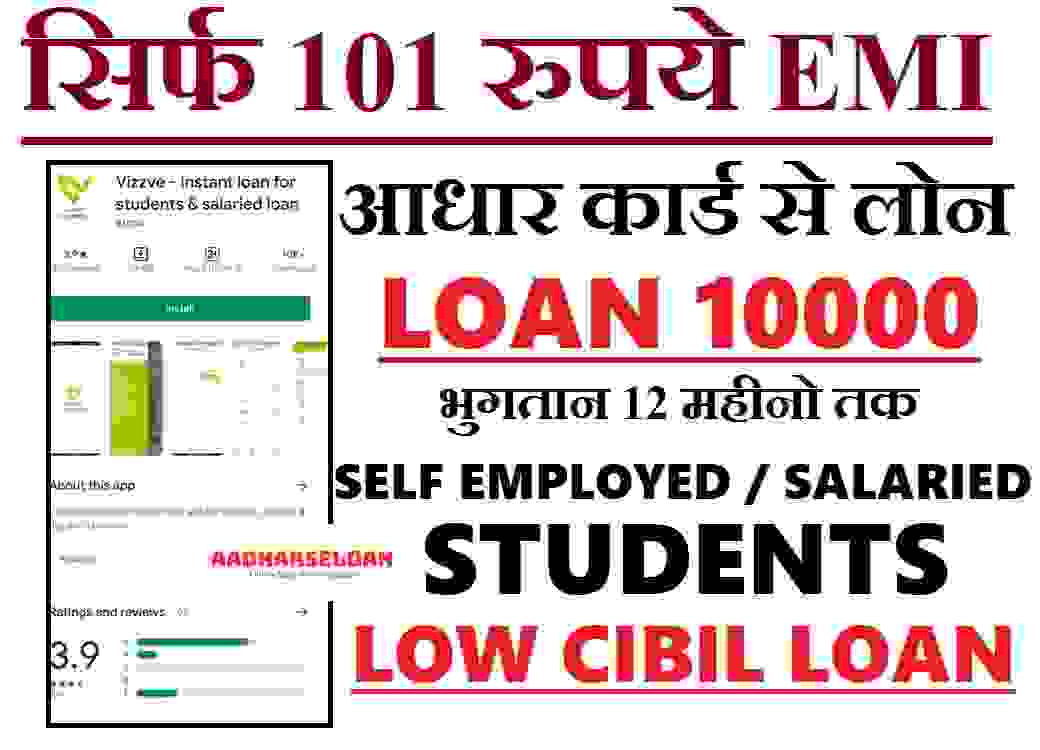

To use these student personal loan apps, you just need to have a College ID and Aadhaar, and without any extra charges, you can take a personal loan up to Rs. 10000 sitting at home in case of sudden need in a few minutes, this All loan apps give payment time with interest, which ranges from 3 months to 6 months depending on your eligibility, initially this personal loan is very less but as the payment is on time you get more. Personal loan without any guarantee and security.

इन छात्र व्यक्तिगत ऋण ऐप्स का उपयोग करने के लिए, आपके पास बस कॉलेज आईडी और आधार होना चाहिए, और बिना किसी अतिरिक्त शुल्क के, आप रुपये तक का व्यक्तिगत ऋण ले सकते हैं। अचानक जरूरत पड़ने पर कुछ ही मिनटों में 10000 रुपये घर बैठे पाएं, यह सभी लोन ऐप ब्याज के साथ भुगतान का समय देते हैं, जो आपकी पात्रता के आधार पर 3 महीने से 6 महीने तक होता है, शुरुआत में यह पर्सनल लोन बहुत कम होता है लेकिन जैसे-जैसे भुगतान जारी होता है समय आपको अधिक मिलता है. बिना किसी गारंटी और सुरक्षा के पर्सनल लोन |

Student Personal Loan App Benefits

- If you are a college student, you can take a personal loan up to Rs 10,000 without any guarantee or security.

- You get up to 6 months of payment along with interest.

- No credit score required

- There will be no need for physical verification.

- In case of sudden need, this loan is credited to your account in less than 30 minutes.

- You can take this Student Personal Loan for any of your needs.

- 100% digital paperless process for loans

- You can apply for this student loan from any corner of India.

- Here we will know all about RBI Approved Student Personal Loan App.

- With timely repayment, your loan limit increases so that you can get a bigger loan next time.

- No additional payment of any kind will have to be made before the loan

- Income proof or any kind of income proof will not be required

Student Personal Loan App Eligibility

- You Must Be A College Student

- Must Be An Indian Citizen

- Must Be Above 18 Years Of Age

- Mobile Number Linked To Aadhaar Will Be Required

- Must Have Paytm Account Or Savings Account

- Smartphone Will Be Required To Apply

- These Student Loan Apps Should Also Serve Your City

Documents For Student Personal Loan App

- Collage ID

- PAN

- Aadhaar Card

- For Selfie Photo From Student Personal Loan App

- Aadhaar OTP Will Be Required To E-Sign The Loan Agreement.

Student Personal Loan App Fee & Charges

- Interest – Initial 20% To 36%

- Processing Fee – Up To 5%

- Penalty – On Late Payment Of Loan

- GST – Whatever Fees And Expenses Will Be Up To 18%

- Joining Fee – No Need To Pay

- Activation Fee – No Need To Pay

- Annual Fee – No Need To Pay

Student Personal Loan App List

- MPockket (Loan From Rs 1000 To Rs 30000)

- Sahukar (100 To 5000)

- Pocketly (100 To 10,000)

- BadaBro (100 To 10,000)

How To Use Student Personal Loan App

- Install The Mentioned Student Loan App On Your Phone.

- Register With Aadhar Link Mobile Number

- Choose Student Loan From Self Employed And Student

- Do KYC For Which You Will Have To Upload Documents Along With Personal Information And Also You Will Have To Provide Your Paytm Details Or Saving Account Information To Get It.

- Now If You Are Eligible Then Within Some Time You Will Be Eligible For Personal Loan.

- To Take This Loan, Confirm The Loan Agreement Through Aadhaar OTP.

- Now Your Student Personal Loan Will Be Credited To Your Account After Approval.

Make The Payment On Time So That You Can Get A Bigger Loan In Future, But Always Use Any Of These Personal Loan Apps Only When The Need Is Urgent.

अगर आपको हमारा आज का आर्टिकल पढ़कर अच्छा लगा हो तो उसे अपने दोस्तों के साथ अवश्य शेयर करें।